Free Online Income Tax Filing if AGI <$79k + some Free State Returns

We may earn money from the companies mentioned in this post.

Am I the only one out there who loves tax time? We go easy on the W4 allowances, so when tax time comes around, we always have a big ol’ refund. Plus, I get to nerd out on numbers. As much as I enjoy both of these concepts, I don’t want to actually pay to get file my taxes. Eww. And since H&R Block did away with their free file program that I used in the past (boooo), I did some frugal exploration–also something I nerd out on–into free filing options. So, who’s offering what type of free online income tax filing programs in 2024?

Make less than $79k? Nice.

This year, I’m going a different route. I’m using one of the eight IRS “free file” offers.

{This was originally written in 2021, updated for 2024.

Tired of free online income tax filing programs that aren’t really free?

Bait-and-switch “free online income tax filing” offers got you down? You know the ones that sneakily say you can start your taxes for free, but always end up making you pay to actually file if you have any kinds of pesky investments or deductions? Say no more.

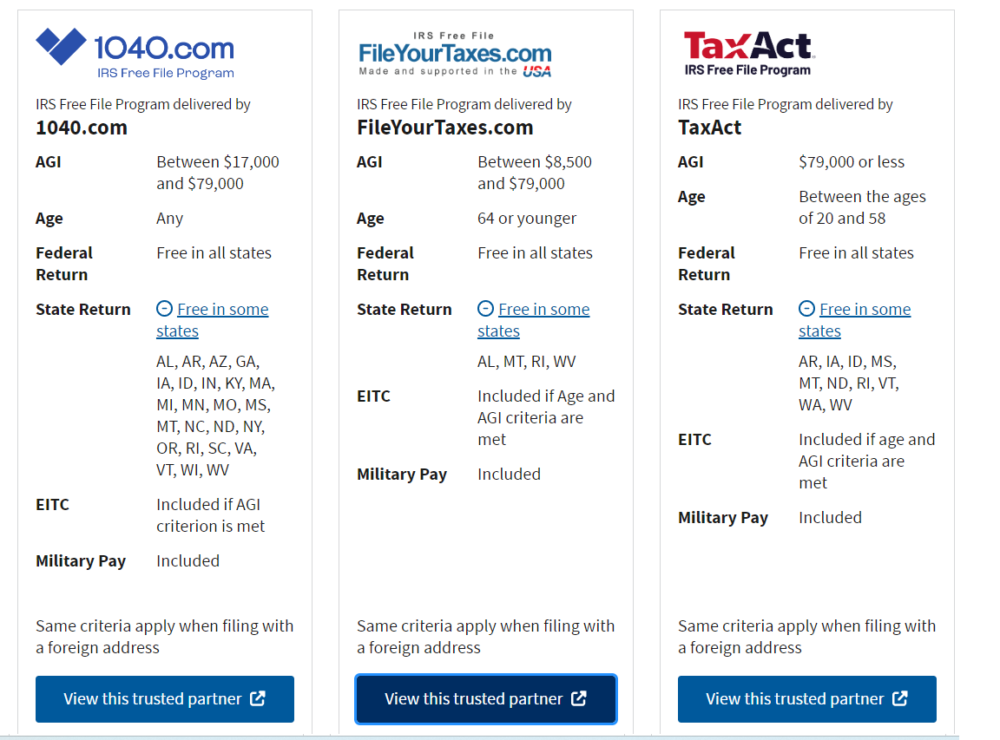

Our dear IRS has done the work for me when it comes to free file offers. Their site shows eight free filing options for adjusted gross incomes below $79k, and I outline three of the more promising ones (sites with a higher eligibility AGI amount) in my table below.

In true geek fashion, I compiled my findings in table format for your delight, but also (mostly) for my own. Here are the three tax companies that offer the highest income limits ($79k) plus at least some free state return offers.

| Free File Program | Income Limit | Free State Return Too? |

|---|---|---|

| Tax Act | $79k or less + age 20-58 | AR, AZ, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NH, NY, OR, RI, SC, VA, VT, WV. Other state returns are $39.99 |

| 1040.com | $17k-$79k | AR, AZ, DC, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NY, OR, RI, SC, VA, VT and WV. Other states = $9.99 |

| Fileyourtaxes.com | $8,500-$79k + younger than 64 | AL, MT, RI, WV |

I was a little apprehensive about going with a completely free, new-to-me program to do my taxes. My worries were unfounded–nay, completely ridiculous. Taxact couldn’t be easier, and I love how it gives you a running total as you add information. Why did I choose Taxact? It’s the most likely one we’ll continue using if/when our AGI exceeds $79k, and it has a great reputation. Plus, I often see cash back deals for it on my credit card (if/when we need to purchase it). The other sites look a little bare bones in comparison, which is okay, but a bare bones appearance makes me wonder if the service and tax tips are also lacking.

I also read in a forum that 1040.com tries to charge you for the federal file, even if you use the free filing link from the irs. Yikes!

I filed my taxes on with Taxact on a Monday and received my federal refund the following Monday! The state refund took about three weeks because that’s how Idaho rolls.

Free file programs make taxes a blast

Whether you’re getting a big ol’ refund or you owe money to the IRS, you don’t have to pay to find out.